Our Process

The UGA Startup Program provides UGA faculty and students support to launch and grow UGA startup companies. These startups are typically built around intellectual property arising from UGA research and student projects. Our programs are designed to be flexible and tailored to each entrepreneurial project to provide actionable steps that have proven to result in successful companies and experiences.

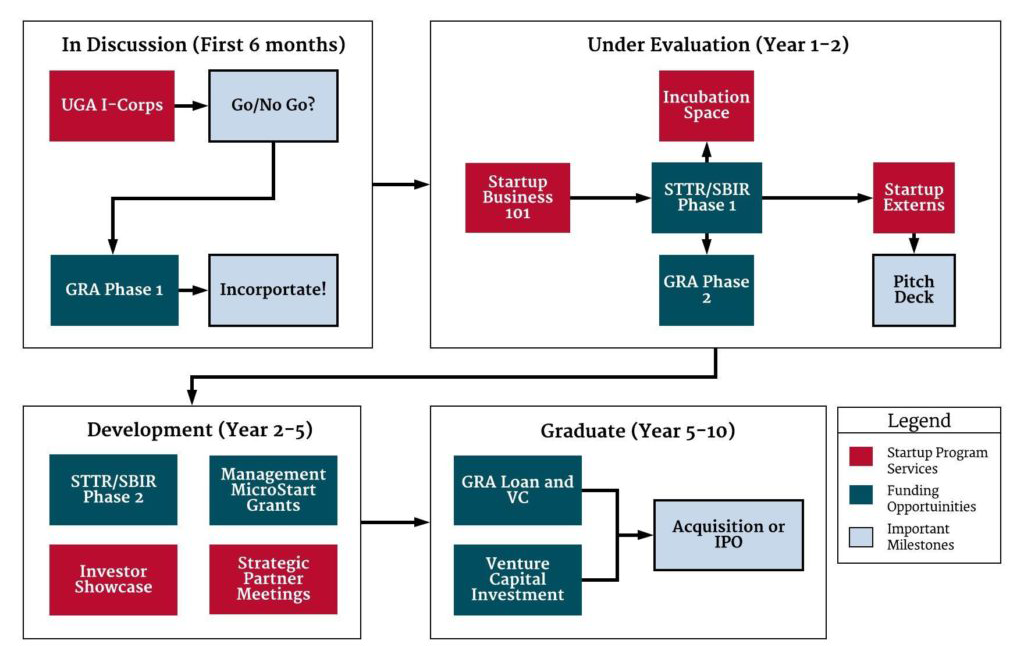

Pathways for Startups

A standard pathway for startups going through UGA would look something like this:

In Discussion

Let’s have a chat and see what your venture is about and how do we go about evaluating if it is worth pursuing. Contact Monica Williams at mswill@uga.edu to schedule a meeting with someone from the Startup Team!

Go/No-Go?

An essential part of the I-Corps process is to evaluate whether to continue with the project because of clear market demand or to pivot/stop pursuing the idea because of lack of a large enough market to support a startup company (Go/No-Go).

Go Congratulations! You seem to have identified a market and people that will pay for it! Time to make that idea reality. First Step: Funding!

No-Go Choosing to stop pursuing a venture is NOT a failure, rather it is a mature show of knowledge and discipline. Think of it as, “For the low cost of $3000 and ~3 months, I feel confident I shouldn’t waste more of my time on this.”

GRA Phase I

Georgia Research Alliance (GRA) focuses on commercializing technologies and discoveries emerging from Georgia’s research universities. They are also big fans of job creation for Georgia. For their Phase I funding, they offer a total of $50,000, which is delivered in two tranches of $25,000 and the work is expected to be completed in 6-12 months.

To get started, it is required that you meet with a member from the Startup Program to discuss your plans for the funds and to work on the Pre-Proposal for review by UGA and then GRA. Note, a startup company is not required to be formed before applying for Phase 1 funding.

Incorporate!

There are different ways to incorporate your venture depending on the type and number of people involved.

Single Member LLC

Simplest and quickest incorporation strategy. If there is more than one founder, the team will commit to changing the structure at a later date. Ideal project type: student teams

Multi-member LLC

Limited liability corporation incorporation for a project with more than one founder and with future plans to produce revenue within the first five years of incorporation. The LLC founders will own percentage of units of the company and no shares are distributed. If investment is needed for your project to progress, LLC’s can be converted to C Corporations before investment is processed. Ideal project type: faculty teams with a research tool, diagnostic or consumer product

C Corporation

C Corporations are for projects that will require outside investment through angel investors or venture capitalists. C Corporations are set up with shares and a starting share price (generally $0.001). C Corps also need a board of directors, vesting for the founders and documentation to support bringing on board members and management in the future. Ideal project type: faculty teams with a therapeutic, advanced material, engineering, medical devices or some diagnostics

Under Evaluation

You have incorporated into a “company” that is an incubation vehicle to apply for grants and other funding sources. Time to find money so your business can start doing work.

SBIR/STTR Phase I

If you are coming from academia, you are probably familiar with the many federal agencies that give out grant funding for research. These agencies are also vested in translating that research to market, through the Small Business Innovation Research (SBIR) or Small Business Technology Transfer (STTR) grants.

SBIR The Small Business Innovation Research (SBIR) program is a highly competitive program that encourages domestic small businesses to engage in Federal Research/Research and Development (R/R&D) that has the potential for commercialization. Through a competitive awards-based program, SBIR enables small businesses to explore their technological potential and provides the incentive to profit from its commercialization. By including qualified small businesses in the nation”s R&D arena, high-tech innovation is stimulated and the United States gains entrepreneurial spirit as it meets its specific research and development needs. STTR Small Business Technology Transfer (STTR) is another program that expands funding opportunities in the federal innovation research and development (R&D) arena. Central to the program is expansion of the public/private sector partnership to include the joint venture opportunities for small businesses and nonprofit research institutions. The unique feature of the STTR program is the requirement for the small business to formally collaborate with a research institution in Phase I and Phase II. STTR”s most important role is to bridge the gap between performance of basic science and commercialization of resulting innovations.

STTR/SBIR Phase I grants usually come out to ~$150k.

GRA Phase II

GRA has funded a Phase I grant and you successively met your milestones. Phase II generally requires a Phase I award to be eligible. In rare cases, GRA may fund projects straight at Phase II but please contact a UGA Startup Team member to discuss further.

GRA Phase II grants generally have a maximum award of $100,000 and are focused on commercialization of the technology (I.e. scale up, small scale manufacturing, pre-clinical animal testing, etc.). The Phase II grants require a match from another funding source which includes investment (seed funding from angel or VC) or a grant (SBIR or STTR Phase I).

The process for Phase II is identical to Phase II and the funding is considered research funding for the commercialization of a UGA technology. Contact a UGA Startup Team member to work on the Phase II application.

Incubation Space

One metric your company will be evaluated on in the SBIR/STTR application is the company’s ability to complete their scope of work within the startup company. Other than skilled and relevant personnel, this usually also means a need for facilities to complete their specified milestones. UGA is unique in that it does have an on-campus incubator that can help boost your company’s capabilities. The Startup program currently has 25,000+ square feet of incubation space set aside specifically for UGA startup companies.

Residents of the UGA Incubator get access to Core facilities in a fee-for-service model, as well as other UGA resources including internet access and parking.

Pitch Deck

The Pitch Deck will be a presentation slide deck that can be used for investor, partner or grant meetings and applications.

This will be extremely helpful in conveying your vision to potential investors and customers. We will work with you to create two versions: a reading deck to be sent prior to the meeting that is more text heavy and explains your product/service and a pitch deck that removes all extraneous text and is designed to get your message and value proposition across to potential investors or partners.

Development

Your company now has a bit of money, some space, and maybe a real product! Now you need more money to scale-up to the point where you make it out on your own, or get bought up by a bigger player.

SBIR/STTR Phase II

If your company was able to meet the milestones set out in your SBIR/STTR Phase I, you can now apply for an SBIR/STTR Phase II from your same funding agency, which can grant around $1 million+ for your startup to begin scaling up and pushing your technology closer to market or acquisition.

Management MicroStart Grants

One of the Startup Program’s focus areas is to connect UGA startup companies with talented and capable business people to help with commercialization of the UGA technology. A common pitfall of inexperienced faculty entrepreneurs is giving away large amounts of equity to C-level positions early in the lifespan of the company. The MicroStart Grants are designed as deliverable based consulting arrangements between the UGA startup and the potential C-level employee. The focus can be on a business development role, fundraising, partnering, or pitching the company. Ideally, the startup and the potential management person have time to understand the relationship and can try out working together before a long-term commitment is established. Contact Tim Martin for more information.

Investor Showcase

Through the connections of the UGA Startup Program, our team will be working with major investors in the Southeast to establish opportunities to showcase our startup companies. Our goal is to develop a schedule of events and opportunities to interact with investors in Athens as well as at events across the Southeast (GA BIO, SEBIO, SEMDA, etc.). Please stay in contact with the Startup Team for updates on our next scheduled events.

Strategic Partner Meetings

Another key to success for many university spin-out companies is the ability to partner with large corporate companies for development, scale-up or sales/distribution deals. The Startup Team will be attending major industry conferences (BIO, CES, JP Morgan Healthcare, RESI) to showcase UGA startup companies. Creating relationships with corporate leaders in the different industries will enable UGA startups the ability to collaborate with and to get funding from corporate partners. Please stay in contact with the Startup Team for updates on our next scheduled opportunities to meet with corporate partners.

Graduate

Congratulations! You now probably have a real management team, some advisors and employees. You are a real, functioning company now!

Too bad you still need money faster than you can produce it, so let’s take a look at some options available:

GRA Loans and Venture Fund

GRA’s Loan program is designed as a startup-friendly loan, up to $250,000, that will enable scale-up or go-to-market for applicant companies. In industries that require less overall capital (engineering products, advanced materials, agricultural technology, etc.), the loan program can be a great way for a company to raise non-dilutive funding to accomplish their goal of creating jobs in Georgia.

The GRA Venture Fund is a one-of-a-kind, public-private fund that fuels high-potential, research-based startups in Georgia to growth and stability. The GRA Venture Fund is targeted at Georgia startup companies based on research innovations and will complete equity investments in UGA startups. Ideally, the Venture Fund targets investments from $200,000-1,000,000. The GRA Venture Fund is a great resource available to UGA startup companies and can leverage their network to find other syndicates for a Seed or Series A round. For more information on GRA Loans or GRA Venture Fund, please contact a Startup Team member to discuss your plans.

Angel Investors

Angel investors (also referred to simply as angels) are high-net-worth individuals who invest their own money in startups either individually or as a group (angel network). Angel investors typically invest small amounts of money ($10k-500k) and generally expect a return on their investment (sale of company or exit) within 3-5 years. Angels generally invest in industries they have direct experience working within and have historically focused on consumer, digital/SaaS or non-FDA regulated products. Locally, the Athens Angels and Bio/Med Investor Network are organizations the Startup Program can help UGA startup companies interact with. Typically, angel investments occur at the seed or Series A rounds of investment and generally, they do not lead the investment wherein an investor would be responsible for due diligence. Angel investors will typically want to be hands-on with their investments to ensure the success of the investment.

Venture Capital Investment

Venture capital investors (VCs) are firms focused on investing other people’s money utilizing their full-time partners’ expertise and connections to evaluate and select specific investments to make over the life of the fund they have raised. VC firms will typically raise a fund that will have a roughly 10-year lifespan that can range from $50M to well over $1B. Within that 10 year span, let’s say they invest in 10 companies. From those 10 companies, they expect 4 companies to fail, 2-3 companies to break even (money returned equals money invested), 2-3 to provide a modest return (money returned is 2-3x the money invested) and 1 to be a blockbuster success (money returned is 10-20x the money invested). This business model results in investments that will have a comprehensive review of the company before investment which is referred to as due diligence. VC investors will typically invest in companies that need large amounts of capital to get to market (biotech, pharmaceuticals, medical devices, high-tech engineering products, or large-scale consumer products like Apple or Uber). VCs can come in many different flavors such as institutional VC (investing other people’s money like from a pension or hedge fund), corporate VC (wholly owned or affiliated subsidiary of a large corporate entity such as Johnson and Johnson or Google), philanthropic VC (affiliated or partially owned by a foundation such as Gates or American Cancer Society) and university VC (funded or affiliated with a university such as UNC-CH). Typically, VC investment occurs at a large seed stage ($1-5M), series A ($5-20M), series B ($20-100M), series C/D/E (>$100M), etc. The Startup Program can provide introductions to local and targeted VC firms once the startup company has proven technical and market feasibility through the I-Corps and STTR/SBIR programs

Acquisition or IPO

The last step in a startup’s lifecycle is generally an acquisition or an initial public offering (IPO) and is typically called the “exit” when referring to a startup company. Acquisition or IPO is considered an exit because it is a trigger for all shareholders in the startup company (founders, employees, investors, debt holders) to be paid based on the number of shares they hold and the share price at exit.

Acquisition occurs when another company (generally a large corporate competitor or partner) purchases the shares and rights to the startup company. In the past 20 years, acquisition has become a consistent exit for startup companies because it is attractive to the large corporate partner to add a complete, developed product that has passed regulatory hurdles, established sales channels or possibly already has a growing customer base. Typically, the acquisition comes with requirements of the startup company including a vesting period that they must be part of the acquiring company and all existing licenses and contracts will generally be renegotiated by the acquiring company.

IPO involves the company going public by allowing anyone to purchase shares in the company. IPO is considered an exit because when the company is listed on the public market, the initial shareholders now own shares in the company at the public price. For example, if an investor owns 1,000,000 shares of a startup company and they were purchased at $5.00 per share, then the investor now owns 1,000,000 shares of the public company that is valued at $20.00 per share. The investor’s investment increases in value from $5M to $20M immediately upon the public offering and that is typically when they will sell (exit) their shares to return those profits to their fund’s investors. IPO is less common than it was in the ’90s and 2000s but is still an attractive option for companies that need to raise significant funding (e.g., therapeutics) to get to market.

Innovation Bootcamp

The Innovation Bootcamp is a focused seven-week program that delivers cohort-specific training in order to equip attendees with the key skills needed for success in an innovative, entrepreneurial environment. Participants will meet weekly to learn firsthand about the basics of commercialization and targeted skill building, as well as receive one-on-one support from experienced coaches and successful entrepreneurs.

UGA Entrepreneurship Program

The UGA Entrepreneurship Program is a collaborative entrepreneurship initiative, housed in the Terry College of Business, serving UGA and our community. Their goal is to develop the entrepreneurial spirit of all interested students at UGA. True to UGA’s commitment of excellence, their events and programs empower the next generation of innovative leaders. Click here to learn about their student entrepreneurship opportunities and programs.